India’s Central Bank Hikes Rates, Government Pushes Privatization Amid Devastating Floods

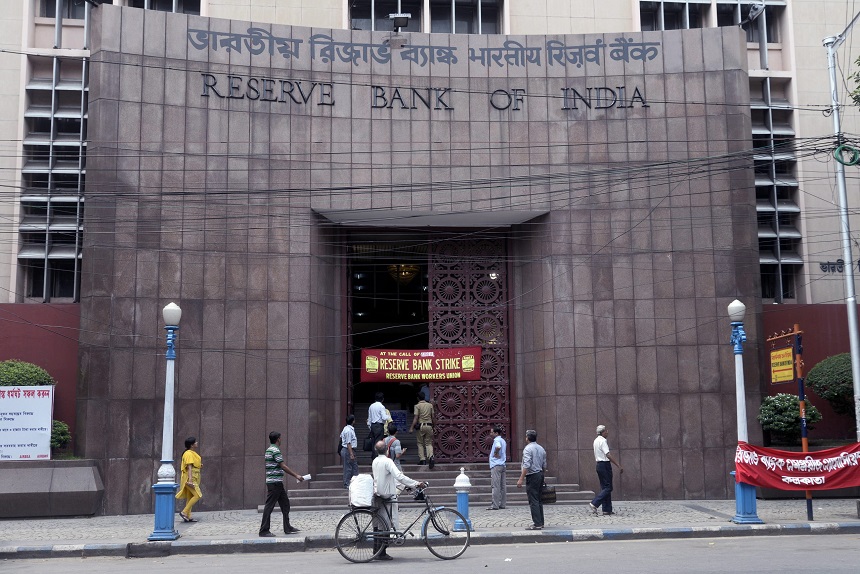

India’s Central Bank Acts to Curb Inflation

In a move aimed at reining in persistently high inflation, India’s central bank, the Reserve Bank of India (RBI), has implemented another interest rate hike. This is part of a broader policy shift by the RBI to cool the country’s overheating economy.

The latest rate increase brings the key lending rate to 6.5%, marking the seventh hike since May 2022 as the central bank battles stubbornly high prices. India’s headline inflation rate has remained above the RBI’s target range of 2-6% for over a year, reaching as high as 7.8% in April 2023.

“Inflation continues to be the biggest challenge facing the Indian economy,” said RBI Governor Shaktikanta Das. “We must act decisively to bring it under control and anchor inflation expectations.”

The rate hikes are designed to make borrowing more expensive, leading to reduced consumer spending and investment. This, in turn, is intended to ease demand-side inflationary pressures in the economy.

However, the RBI has struck a delicate balance, seeking to curb inflation without stifling the country’s economic growth. India’s GDP expanded by 6.3% in the last quarter of 2022, outpacing many other major economies.

“We are cognizant of the growth implications of our monetary policy actions,” Das explained. “But our primary focus right now has to be on restoring price stability, which is essential for sustainable growth in the long run.”

The central bank’s hawkish stance has drawn some criticism from businesses and consumers struggling with higher EMIs and lending costs. But Das has maintained that firm action is necessary to prevent inflation from becoming entrenched.

“We understand the pain that higher interest rates are causing, but it’s a necessary evil. Allowing inflation to spiral out of control would be far more damaging to the economy in the long term,” he said.

Privatization Push Amid State Sector Overhaul

Alongside its monetary policy actions, the Indian government is forging ahead with plans to privatize several state-owned enterprises (SOEs) as part of a broader effort to streamline the public sector and attract more private investment.

The privatization drive is being spearheaded by the Ministry of Finance, which has identified a number of SOEs across industries ranging from steel and oil to aviation and banking as potential candidates for divestment.

“The government recognizes that the public sector has become bloated and inefficient in many areas. Privatization will help improve productivity, competitiveness, and service delivery,” said Finance Minister Nirmala Sitharaman.

Among the high-profile SOEs slated for privatization are national carrier Air India, energy giant Bharat Petroleum Corporation Limited (BPCL), and banking behemoth State Bank of India (SBI).

The government has also announced plans to consolidate and merge several smaller public sector banks in an effort to create larger, more robust institutions capable of competing with their private sector counterparts.

“We want to create a vibrant, dynamic banking sector that can fuel India’s growth ambitions. Bigger, stronger banks under private management are central to this vision,” Sitharaman explained.

The privatization drive is part of a broader set of economic reforms being pursued by the government of Prime Minister Narendra Modi. Other measures include deregulation, tax cuts, and efforts to improve the ease of doing business in India.

“Our goal is to make India a more attractive destination for domestic and foreign investment. Reforming the public sector and embracing private enterprise is a key part of that strategy,” Sitharaman said.

However, the privatization plans have faced some political opposition, particularly from labor unions and leftist parties who view the move as a betrayal of the country’s socialist principles.

“These are strategic national assets that should remain under public control. Selling them off to private interests is against the public interest,” argued D. Raja, leader of the Communist Party of India.

The government has sought to assuage such concerns by promising to protect employee rights and ensure that privatized SOEs continue to serve the public good. But the debate is likely to intensify as the divestment process gathers pace.

Devastating Monsoon Floods Wreak Havoc

Even as India’s policymakers grapple with economic challenges, the country has also been hit by a series of devastating monsoon floods that have claimed hundreds of lives and caused widespread damage to infrastructure and agriculture.

Heavy rainfall and overflowing rivers have submerged vast swathes of land across several states, including Assam, Bihar, Uttar Pradesh, and Madhya Pradesh. Thousands of homes have been destroyed, and critical transportation links have been severed, hampering relief and rescue efforts.

“The scale of the destruction is simply staggering. Entire communities have been wiped out, and the human toll continues to rise,” said Harsh Vardhan, the minister for disaster management.

According to official estimates, over 500 people have perished in the floods so far, with millions more displaced from their homes. Croplands spanning hundreds of thousands of acres have been inundated, threatening food security and farmer livelihoods.

“This is a humanitarian crisis of epic proportions. We are mobilizing every resource at our disposal to provide aid and assistance to the affected populations,” Vardhan said.

The Indian government has deployed military and National Disaster Response Force personnel to spearhead rescue and relief operations. Temporary shelters, food, and medical supplies are being distributed to displaced families, while efforts are underway to restore vital infrastructure like roads, bridges, and power lines.

However, the sheer magnitude of the disaster has stretched the government’s capabilities, and there are concerns about the long-term impact on the affected regions.

“The damage to agriculture will be felt for months, if not years. Rebuilding homes, roads, and other critical infrastructure will require immense resources and time,” said Anjali Bhardwaj, a development economist.

Environmentalists have also warned that the intensity and frequency of such extreme weather events are likely to increase due to the effects of climate change. They have called for a more proactive approach to disaster preparedness and mitigation.

“We can no longer treat these floods as isolated incidents. They are a harbinger of the new normal that India must adapt to,” said Sunita Narain, director of the Centre for Science and Environment.

As the country grapples with the immediate humanitarian crisis, policymakers will also need to develop long-term strategies to build resilience and enhance the country’s ability to withstand the growing threat of climate-related disasters.